Recommendation: We highly recommend you to change settings from one device only. For example: PC.

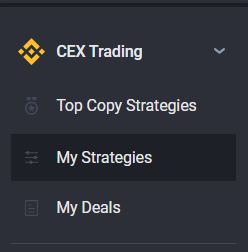

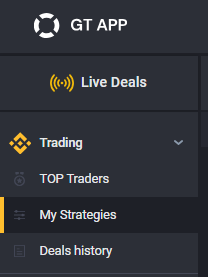

- Choose "My Strategies" on the sidebar

- Click *create spot strategy* button

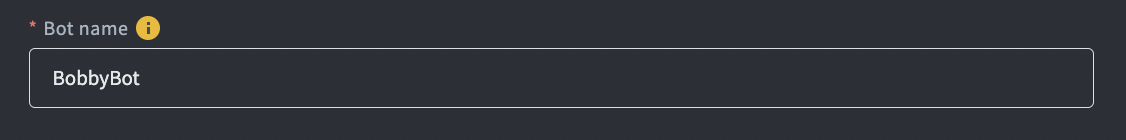

1. Strategy name - that is the name that you give to your strategy.

For example: Bobby

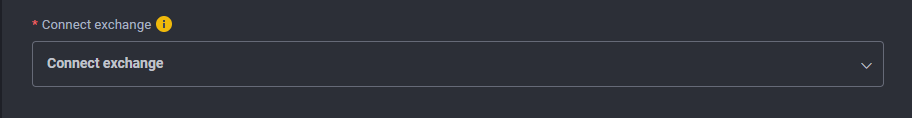

2. Select the exchange where you want the strategy to trade.

For example: Binance

Pro tips: You can choose only the exchange that is already connected to our platform.

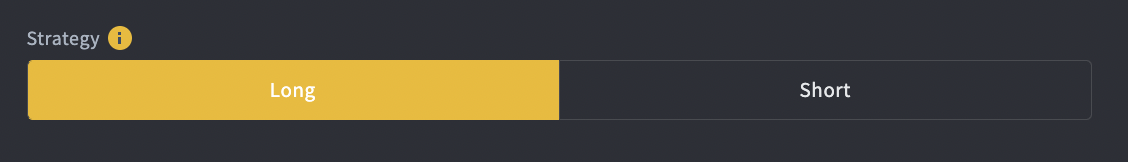

3. Select the preferred strategy. Long or short.

For example: Long

Pro tips: Long strategy is for buying low and selling high. The short strategy is for selling high and buying low. Don’t forget in order to start a long strategy you need to have the quote coin of the pair and to start a short strategy you need to have the base coin of the pair. So if you want to go long with BTC/USDT pair. You need to have USDT on your account balance and if you want to go short, you need to have BTC on your account balance. It would be good to have at least $10 equivalent of right and left currency for each pair during the deals, because Binance taking the fees in the currency being sold right now(means you will need to pay fees in BTC during the Takeprofit order executing).

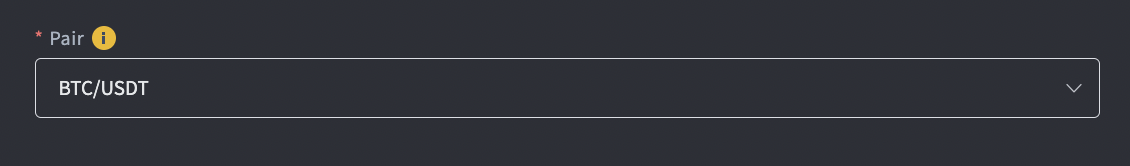

4. Select a preferred pair to trade with.

For example: BTC/USDT

Pro tips: To select a pair you need to do a little research on the exchange. The main things which you need to find out are:

1.) Trade volume - if trading volume is $1,000,000 it is a good coin to trade, which means that this coin is traded for $1,000,000 per 24 hours a day.

2.) Change - Even if trading volume is high, you need to track if the price is changing, Than more it changes, than more profit you can earn.

For example: BTC/USDT pair price change for 5% for a day. So if you’ve started strategy 24 hours before using the long strategy you would earn a minimum of 5% of your current assets.

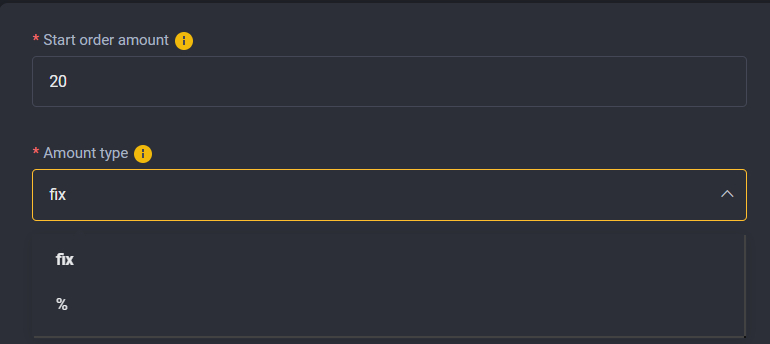

5. Now you need to tell the strategy what amount of money you want it to use.

As a new trader let's start with $20.

Pro tips: You can choose between the exact amount of your asset or the percent amount of your asset.

6. Select the Take profit %.

Then more percent you will choose than more profit you will get, at the same time you will need to wait longer until the rate will change.

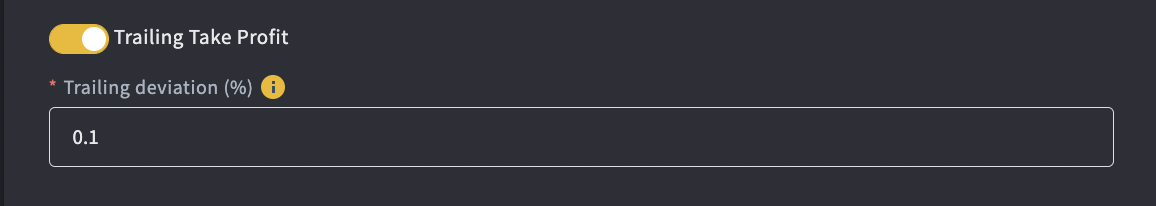

Also, you can enable trailing take-profit. Click here to find out more.

1. Now you need to set up safety orders.

Safety orders are used to level the rate changes.

For example: You have started long strategy with 1% of take-profit. However, the rate falls down by 1%. Safety orders allow to not lose the opportunity to earn more. Because it will buy additional BTC at a lower rate and will replace the current take-profit order with a new take-profit order counting the additional buy orders from safety orders. There are a lot of orders :).

So what do you need to fill in those lines?

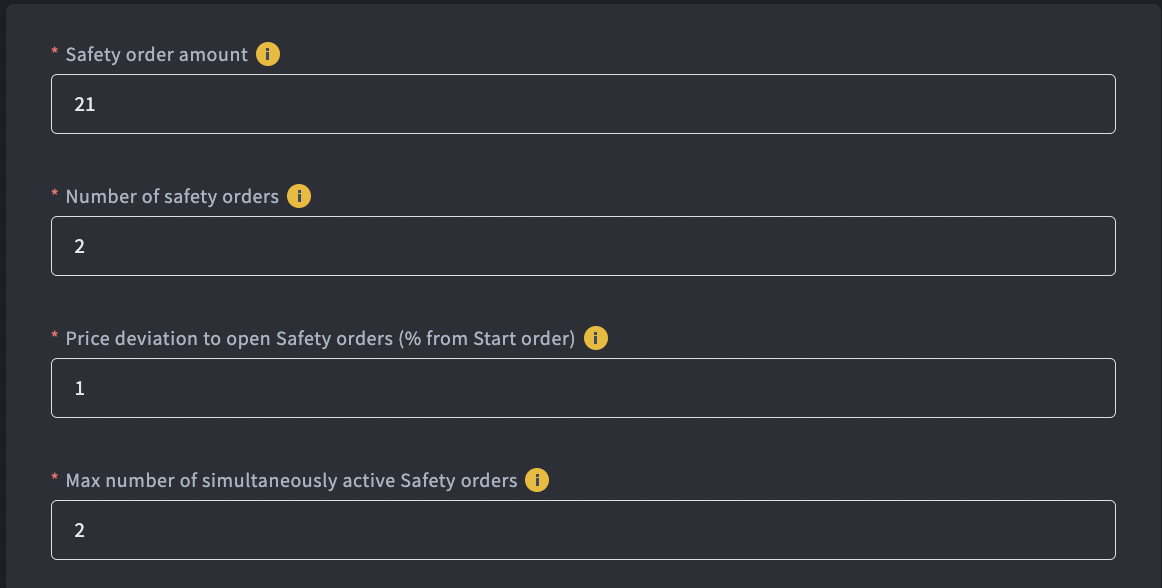

Safety order amount - is how much do you want to buy or sell if the rate goes the opposite direction of your strategy. This number could not be less than the start order amount.

Amount type - as well as with starter order, you may choose between fixed exact amount or percent of your asset.

Safety order quantity - is the total amount of safety orders that will be used during your deal.

Step of safety order (%) - here you select when does safety needs to be executed. By selecting 1%, whenever the rate goes down by 1%, a safety order will be executed.

The count of real-time safety orders - is the amount of placed safety orders.

For example: The total safety order quantity will be 4, however you don’t want them to be placed right away. So you choose only 2 real-time safety orders and once 2 of them will be executed the remaining 2 will be placed.

2. Stop loss.

It is an emergency button. If the rate goes the opposite direction and not going to go as you wish, strategy will buy/sell before you lose more money. There are 2 options of how stop-loss will affect the strategy.

1.) Cancel your deal - strategy will cancel the current deal and wait for the next trading signal to start a new one.

2.) Cancel your deal and stop your strategy - strategy will cancel the current deal and stop. The strategy will not perform any action until your command.

Pro tip: Stop loss will be executed only after all safety orders are executed.

The last step

Once the strategy is created, you have 2 options.

-Wait - You can wait until strategy will catch a trading signal and start deal on its own.

or

-Start deal -If you will start deal strategy will execute the start order immediately