In the latest update of the platform functionality, we have added the ability to work on different timeframes when using an Automated trading signal.

In this article, we'll take a look at all options available to you.

Automated trading signal - works on the basis of Bollinger lines, but modified by the GT App team, very effective for scalping and fast trades.

Now, depending on your trading strategy and analysis preferences, you can set up the strategy to work not only on the 1-minute timeframe. Depending on your choice, the strategy will analyze the situation on the market and enter deals on the TF from 1 minute to 1 day.

How to use different timeframes

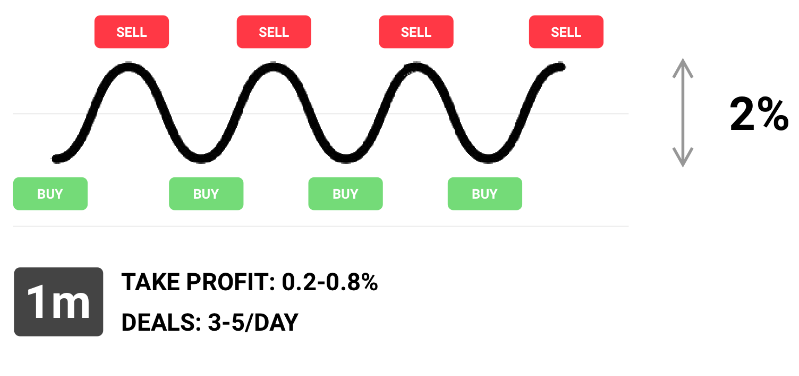

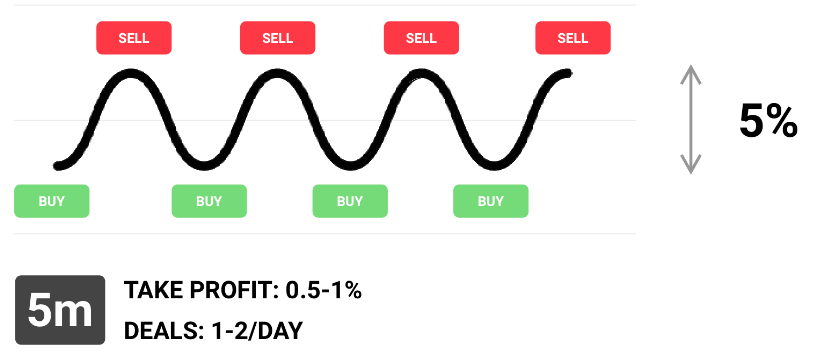

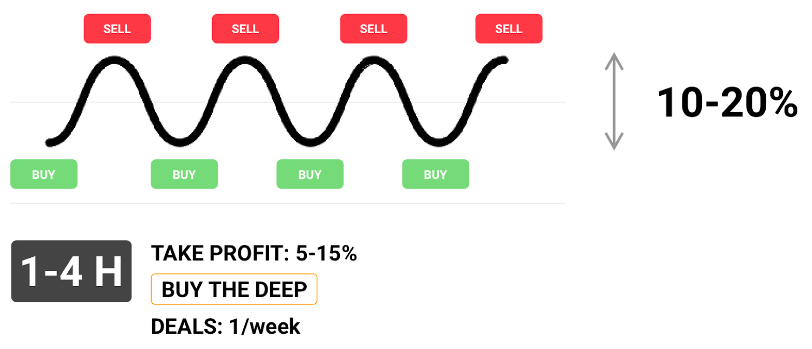

Depending on the selected working timeframe, the number of your trades and the optimal take profit size will vary.

For example, if the market is flat, you can use 1M TF, it will allow you to take away minor price fluctuations. In this case, it is recommended to set up a small take profit that will allow the strategy to execute frequent trades.

When working with 5M TF, the strategy will make deals a little less often (1-2 per day), but this will allow you to take TP about 1%.

Analyzing the strategy on 4H TF will lead to even rarer trades, about 1-2 per week. But this will allow you to buy at the lowest prices and take the maximum percentage of profit.

When placing TP, be guided by the volatility of your trading pair. The most popular coins can be less agile and make 8-10% of the movement on average. Smaller altcoins can expect bigger moves.

BTC Volatility

BLZ volatility

In general, the larger the working timeframe, the less often the strategy enters deals, but the higher the percentage can be indicated in the take profit. And vice versa, a smaller Timeframe, a larger number of deals and a smaller profit size in the settings.

KDJ trading signal - this signal allows you to enter trades according to the parameters of the KDJ indicator.

As with the signal based on the Bollinger Bands, we have made custom configurations. Each timeframe (K-line) has its own individual settings in order to smooth out price fluctuations. You only need to select the required timeframe, the rest of the settings will be made automatically by our system.

The bigger the timeframe you choose for the signal, the less often the entry signals will be received. But they will be of better quality and with a higher probability of working out.

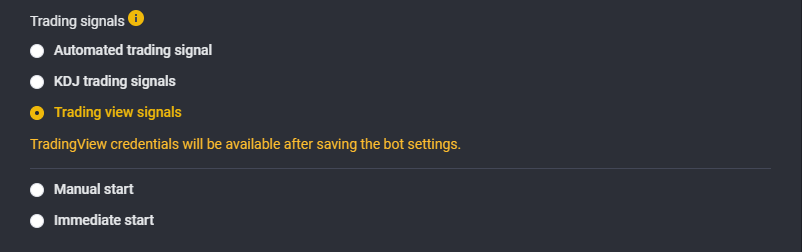

Trading View signals - you can read more about working with this type of signal in this article.

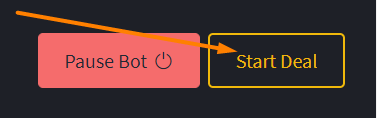

Manual start - allows the strategy to start trade only if the owner presses the start trade button.

This type of signal should be used in situations where the market is not defined, you carefully choose the moment to start a trade. It can also be selected for situations where you don't want to pause the strategy, but you also don't want to expect a start in the near future.

Immediate start - gives a sign to the strategy to start a new deal immediately after the completion of the previous one.

It performs best in situations where the general trend of the trading pair is well known, so transactions will begin immediately, and small price fluctuations will allow you to increase the volume of the transaction on safety orders a little, which will lead to even more earnings.