As a user of our algo trading platform, you might have come across the terms "stop loss" and "stop loss trailing". In this article, we'll explain what these terms mean and why they're important to use.

First things first, what is stop loss? A stop loss is an order placed to sell a security when it reaches a certain price. This is done to limit a trader's loss on a position in a security. For example, if you buy a cryptocurrency at $10,000 and set a stop loss at $9,500, the trade will automatically be closed when the price reaches $9,500. This is to prevent further losses in case the price continues to drop.

Setting a stop order: when it's important, when it's better not to?

Most likely, even the most novice traders are familiar with such terms as “stop loss” and “trailing stop”.

In this article, we will only briefly recall the importance of using these types of orders, highlight the cases when their use is not optimal, and most importantly, tell you exactly how to set them up in your strategy on the GT App platform.

It is an axiom in the world of trading that stop loss is the #1 rule of any risk management strategy. But having a large analytical database of our users' raiding, we can say that this statement is not true in 100% of cases.

A lot depends on your trading style.

So, when is a stop loss required? In classical orders and signal trading, you can’t do without it, that’s for sure. When all 100% of the balance is involved in the deals from the moment you enter it, you definitely need to limit the possible loss. Otherwise, each deal will be accompanied by a chance for a complete loss of balance.

If you prefer to trade a DCA strategy, or more simply, average your entry point with safety orders, then using a stop will not be rational.

A stop loss order must be placed behind all safety orders. By the time the stop loss is worked out, you will already have a large position volume, a lot of money in the orders and a pretty good average entry price. In this case, we prefer not to use a stop. But since we are not financial advisors, the final decision on strategy settings is yours.

Stop Loss Options in GT App Strategies

Percentage and adjustable

Suppose you decide that you need to use a stop loss. How to set it up?

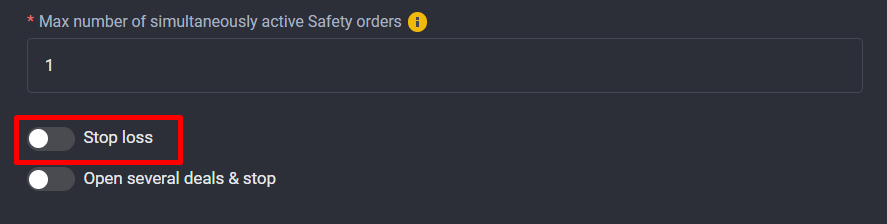

1) When creating the strategy settings, after specifying all the initial parameters, you need to activate the stop function itself.

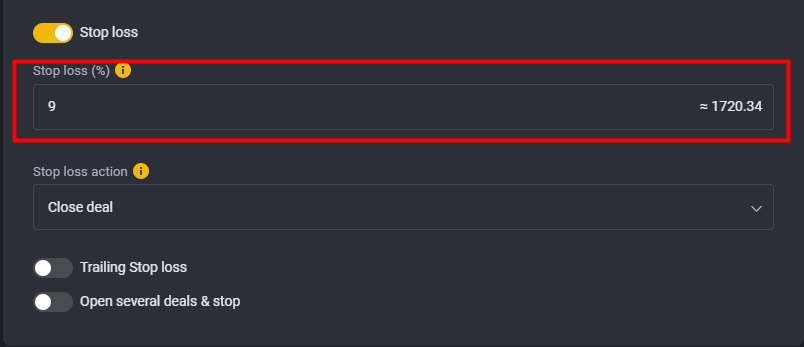

2) Next, set a value for the percentage of price fall / rise from your entry point (fall from the entry point in the case of a long, and price growth in the case of a short).

The strategy will calculate the approximate price at which a stop loss order will be placed.

BUT it is important to remember that you are specifying the percentage of price movement, not the percentage of your balance that you are willing to lose.

This stop loss option will be a great helper in case the price turns against you. It clearly limits your losses and you are freed from unnecessary psychological pressure and risks.

Specify the stop loss order size in percent

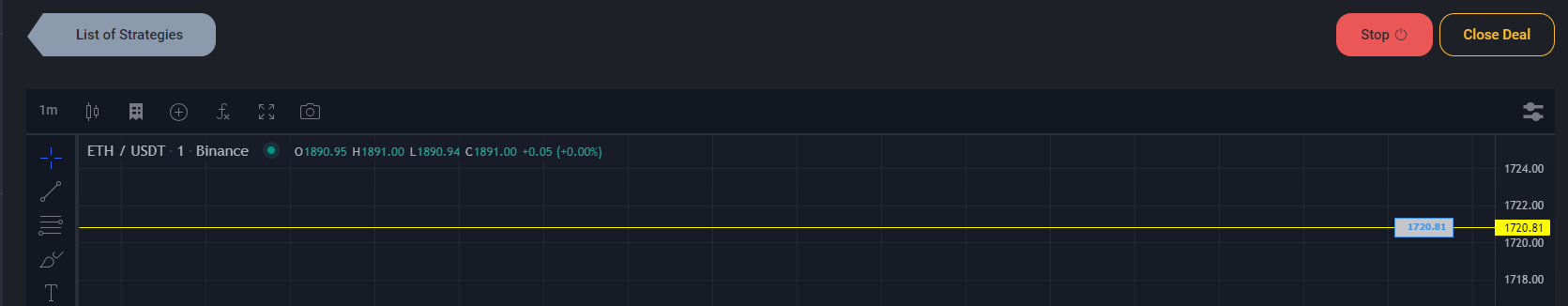

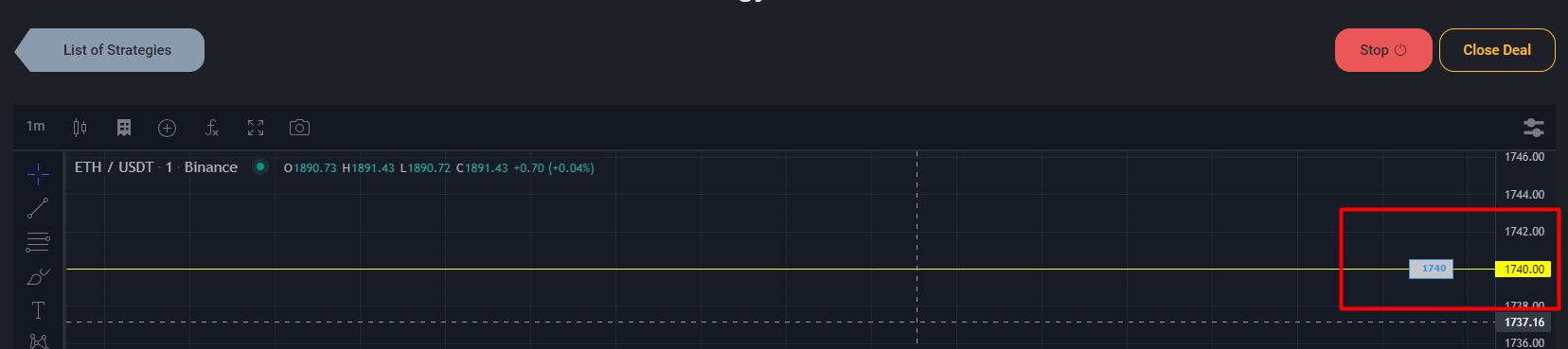

The deal is active. Stop loss order was placed at 1720.81

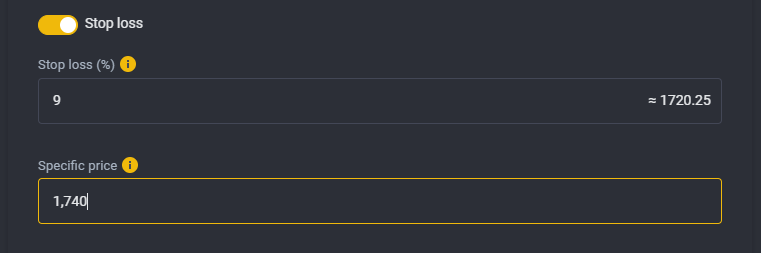

But stop loss is also useful in a situation where the price went in the direction you need. To do this, we added the “Special price” parameter to the stop loss function.

When your trade is already active, go to the strategy settings and you will see a new field appear.

Set a new specific price at which the stop loss order should be placed

Set a new specific price at which the stop loss order should be placed

Stop loss order moved to the specified price in an active trade

Stop loss order moved to the specified price in an active trade

By moving the stop loss order to the specific price, which will be very close to the current price, you insure your profit.

Trailing Stop

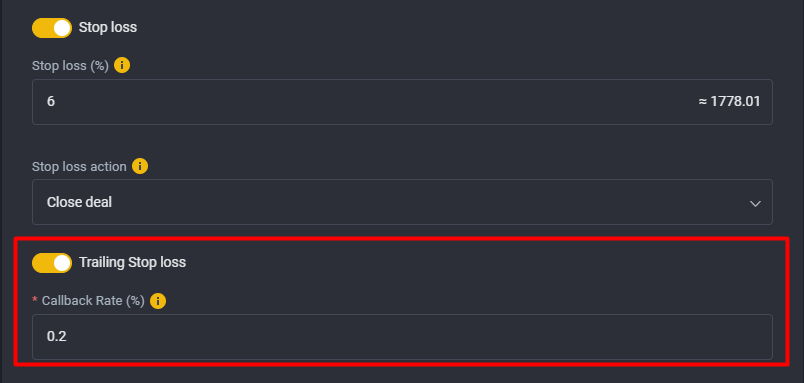

The purpose of this option is to automate the movement of a stop loss order in an active trade.

To activate it, you need to specify a stop loss and the percentage of price movement against the direction of your trade, at which trailing will be activated.

If the price continues to move against the original direction of your trade, then trailing will slightly reduce your loss.

If the price, after activating the trailing (but not reaching the price of the actual closing of the deal by stop loss), turns in the direction you need, then the trailing will allow you to automatically take profits. That is, a stop loss order will independently follow your profit and fix it.

Sample

As shown in the image above, consider an example of trailing with a deviation of 0.2%. We entered the trade long, with a take profit of 1.4% and a stop loss of -1%.

The price went against us by 0.3%. With this, she activated our trailing.

1) If the price continues to move against us, then the deal will definitely close in the negative on the stop loss order.

2) But if the price activated our trailing and turned in the long direction, then our stop loss order will automatically move up (if we work in the short direction, then the stop loss will go lower). Thereby reducing our possible loss.

3) If the price continues to move very confidently in our direction, then the following will happen:

- each move of the current price 0.2% up (our trailing deviation size), our stop loss will also move 0.2% higher.

-if the price moves 7 times by 0.2%, we will just reach our 1.4% take profit.

4) If the price makes, for example, 5 times such a movement, advances by 1% and turns against us again, then:

-our initial stop loss order (-1%) by this moment has moved up by the same 1% and is located almost at breakeven.

- if at this stage the price moves against us by 0.2% - our deal will be closed at breakeven, at the last one, where the stop loss order is placed.

-if the price moves against us by less than 0.2% and reverses to long again, the trade will continue and our stop loss order will move further up with the price.

If at some point the price turns against you again, the trailing stop loss will remain at its last price and the trade will be closed with a significantly smaller loss or even a profit.

Resume

Depending on your trading strategy and willingness to be involved in the trading process, you can choose the method that suits you to protect your deposit. You only need to choose one of the functional options that are presented on our platform for competent risk management.

But we strongly recommend that you do not ignore this part of trading and approach the protection of your money responsibly. Even an unplaced stop loss order should be your conscious decision, which will be part of your trading plan.