Support

If you will have any questions or need any help/assistance in setting up your first strategies - please contact our VIP manager in Telegram at @GT_App_CSbot.

We also invite you to join our Telegram community chat. In this chat we discuss market trends and share relevant trading strategies 24/7.

1) How much profit the strategy can earn?

The Profit of the strategy depends on the strategies settings, on your decision to trade long or short and on the market dynamic.

You can launch the strategy using recommended settings.

2) Recommended settings for strategy:

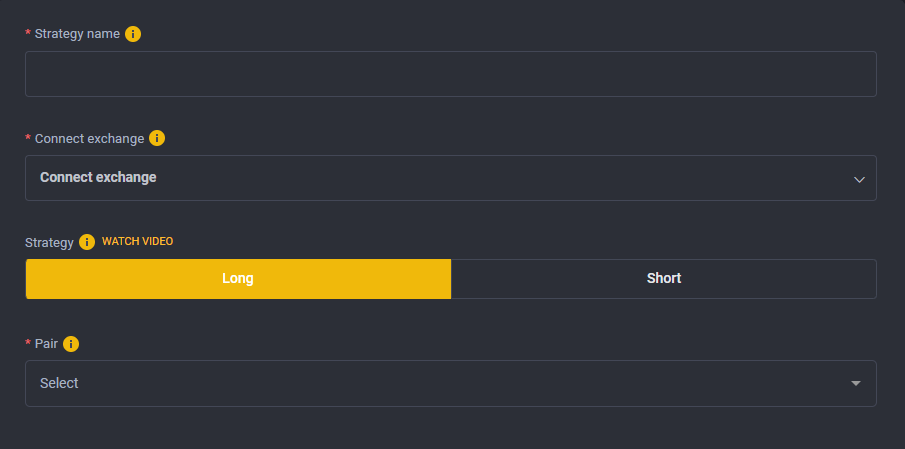

1. Strategy:

- Choose “Long” if you believe that the price will rise.

- Choose “Short” if you expect price dump.

If market trend has changed you can pause the strategy and switch it from long to short.

2. Pair: BTC/USDT

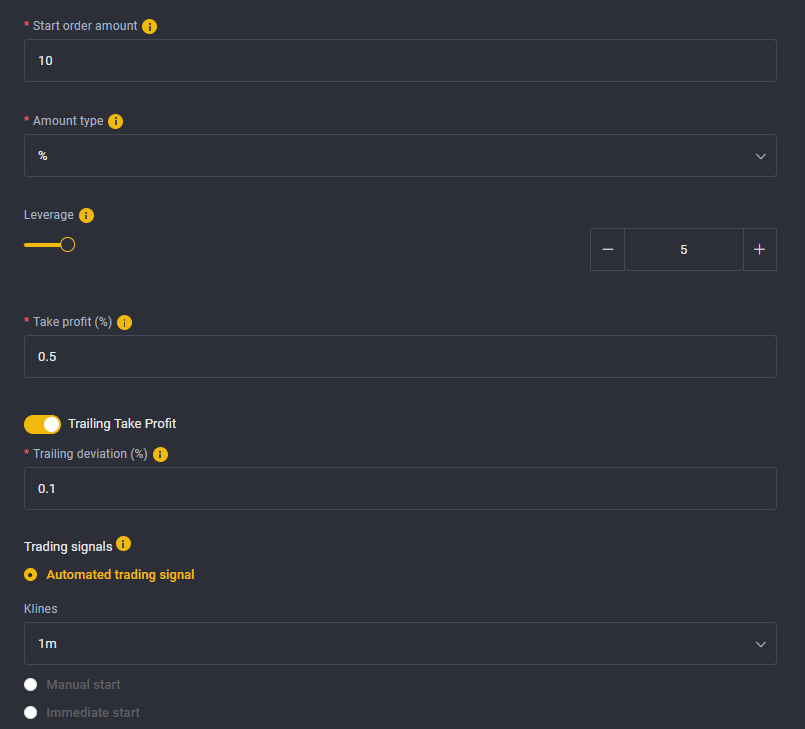

3. Start order amount: the initial margin for this order should be 1-2% from your Futures account balance.

Min. start order amount is 10 USDT.

4. Leverage: 2x-100x

It’s not recommended to use leverage higher than 5x because it is too risky. Lower leverage = lower risks. Higher leverage - higher risks.

5. Take profit: 1%

It’s recommended to don’t set very high take profit %.

If your take profit is ~1% it means the strategy will do often deals several times per day.

If you set high take profit, for example, 10% - the strategy will not close the deal until the market rises for +10%. As you understand, it can take a long time to wait for such a high rise, maybe even several weeks.

But the market pumps and dumps +/- 2-3% in both directions every day.

So you can set 1% take profit to take advantage of high-frequency small price fluctuations to perform several deals per day with 1% profit each.

6. Trailing Take profit: On

7. Trailing deviation: 0.1%

Note: You can read more about safety orders and how they help to average your entry price in this article.

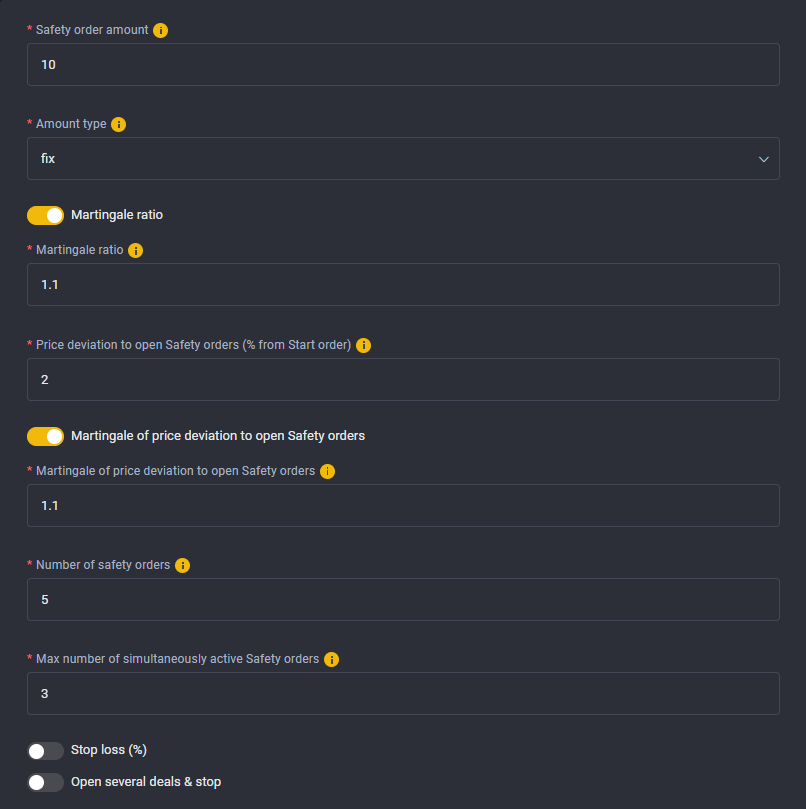

8. Safety order amount = same as your start order amount

9. Safety order quantity - from 10 up to 20 orders

10. Price deviation - 2%

11. Max number of simultaneously active Safety orders - 5

12. Martingale - 1 or 1.1

if you set martingale 1 - then the amount of the start order should be 2% from your futures balance

if you set martingale 1.1 - then the amount of the start order should be 1% from your futures balance. This option is better because your position will be averaging very effectively if the market starts falling.

13. Stop loss: on or off to your choosing.

Stop loss is calculated based on the entry price. If you set stop loss=40% and you opened a new deal at $10,000 price - this deal will be closed by stop-loss order after the price drops 40% down to $6,000 ($10,000-40%).

3) The amount of start and safety orders

Binance Futures platform uses your available balance as a margin for your opened position.

If you involve 100% of your Futures balance in the deal - no margin left on your balance.

It means that the liquidation price of your position will be very close.

We recommend to use ~50% of your futures balance for the deal and 50% as a margin for the opened position.

4) How to calculate how much funds should I have on my futures balance? And how much funds will be involved in the deal?

The initial margin for the deal = The initial margin for the start order + The initial margin for all safety orders

So if you set 1 start order and 20 safety orders, it means you set 21 orders in total.

If each order requires a $2 initial margin, it means that 21 orders will require 2*21=$42 of initial margin to execute all 21 orders.

So you need to have $21*2=$42 on your futures balance at least.

$21 (50% from $84) will be used for the deal and 50% will be used as a margin for your position.

And if you turned martingale to 1.1 it means that the amount of every next safety order will be 10% higher than the amount of the previous safety order. If you set 20 safety orders, then you need to have at least $270 on your futures account balance.

5) We recommend to start your strategy trading with a small budget during 1-2 days to understand how the strategy works.

After you will see the results of several deals and understand how the strategy works we advise to increase the trading amount

6) How to use the strategy? The best use case

Just launch it and allow it to trade. Pause it only if you want to switch it from long to short or vice versa.

Don’t trade or create additional positions or orders on the exchange manually when the strategy is active. Or the active deal will be canceled and the strategy will be paused.

Remember that the main mistake in strategies trading - to take manual actions, they usually bring to a loss.

Give your strategy the opportunity to work and earn some nice profit to you.

The style of trading with a strategy - is to launch it and spend 20-30 minutes per day to switch it from long to short only in case if the market trend changes.

7) Remember that you can launch 2 strategies: long and short at the same time.

Just connect 2 Binance accounts and use 1 account for a long strategy and 1 account for short strategy.

And benefit from both directions of market fluctuations.

8 ) Don’t forget to connect your Telegram strategy by clicking “Step 3. Telegram” in the sidebar menu.

The strategy will send you trading reports 24/7.

If you have any questions you can always reach me in Telegram for a prompt reply - @GT_App_CSbot.

And don’t forget to join our telegram chat, Global Traders Protocol Chat, where we discuss the best trading strategies and ideas.

Support

If you will have any questions or need any help/assistance in setting up your first strategies - please contact our VIP manager in Telegram at @GT_App_CSbot.

Next: How to connect your Telegram account to receive Telegram notifications and trading reports from your strategy