Portfolio is a new GT App tool that allows our clients to manage their spot portfolio by making buy and sell transactions when the market moves in the desired direction. Thanks to this feature, our users' spot assets will grow automatically, without the need to monitor the price and market conditions.

Below you will find the features of the portfolio strategy functionality and the creation process.

Keep in mind that this strategy is designed for trading only on the spot market.

Determine the total budget that you will use in your portfolio strategy and connect the exchange connection.

Select 2 to 10 coins for your strategy and mark the budget that will be available for trading each of these coins.

For each coin, you can mark the basic settings, take profit, and stop loss.

You will be able to view details for each of the coins in the activity logs.

- Conduct an in-depth analysis of various coins and create your unique set.

- Create the most effective set to ensure your well-being.

- The algorithm will perform all actions for you and find effective points for buying, based on the settings you specified.

To connect Portfolio, you need to complete the following steps:

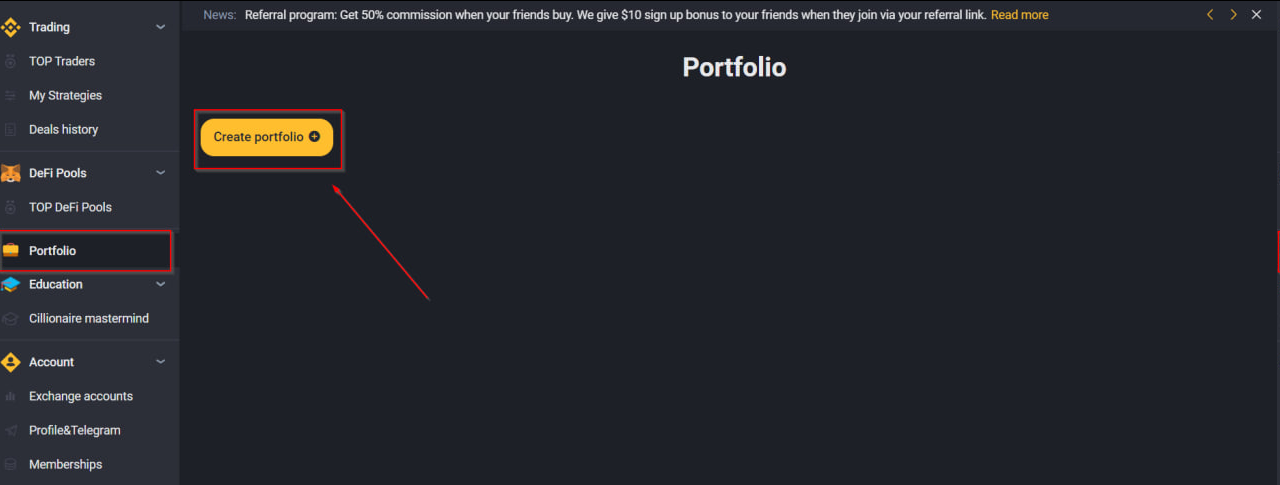

1. On the GT App website, go to the Portfolio tab and click the "Create Portfolio" button.

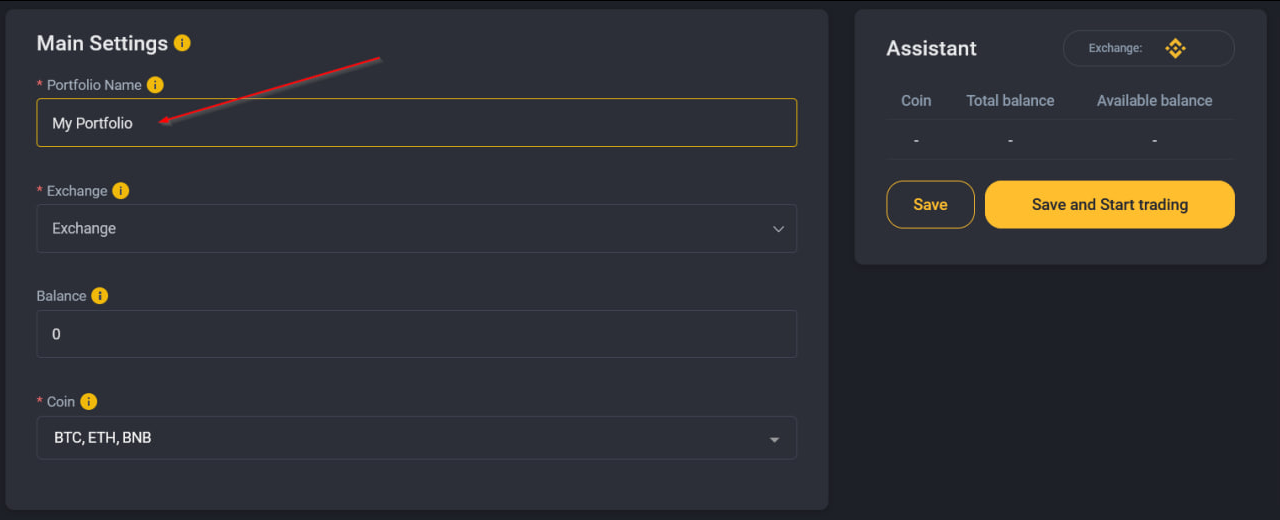

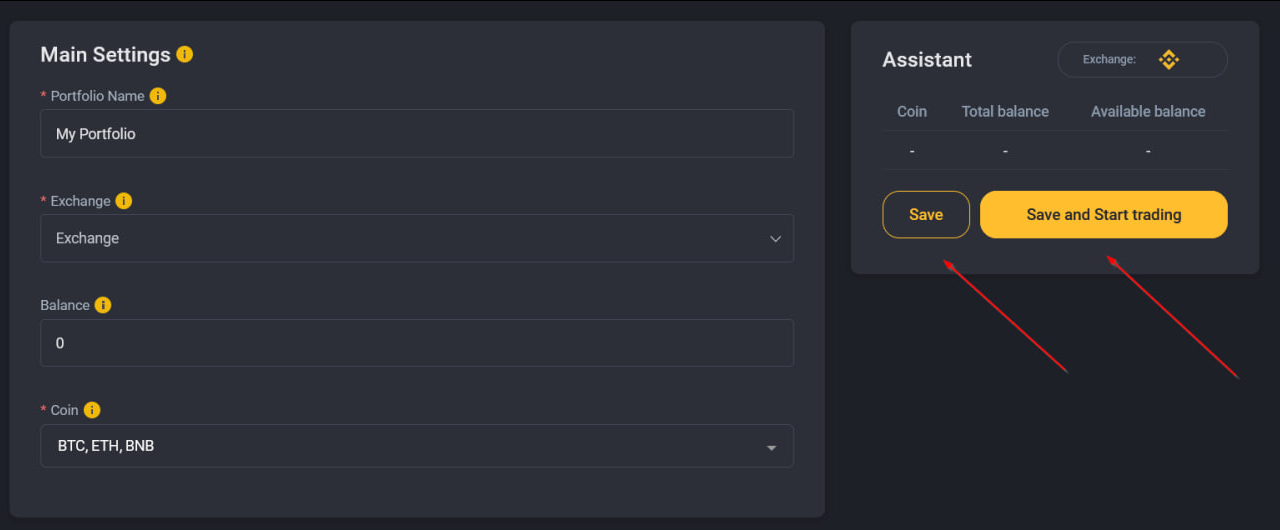

2. Portfolio Name - choose the name of your Portfolio

For example: My Portfolio

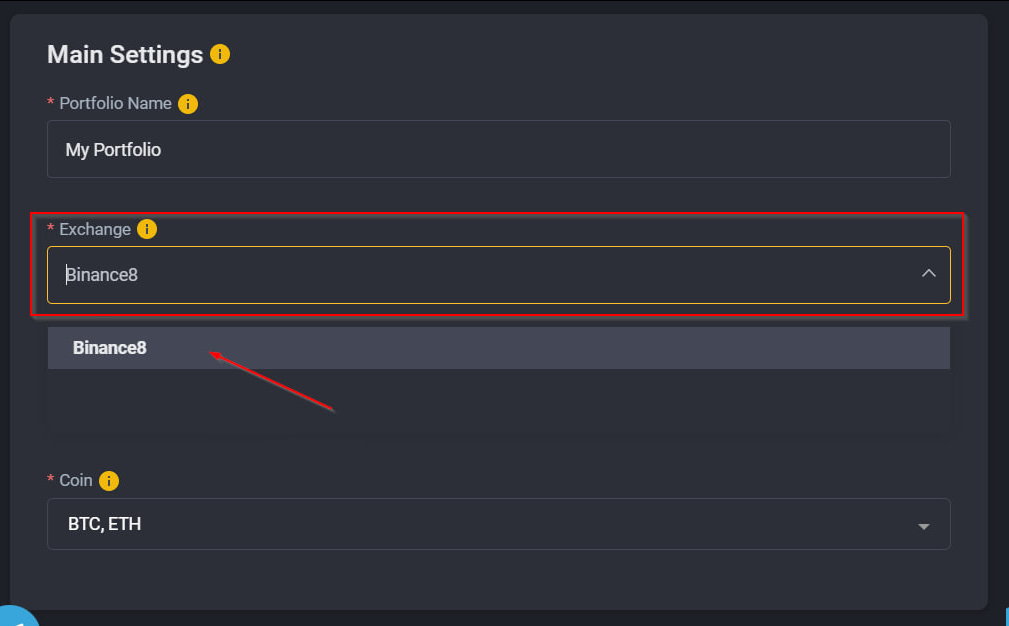

3. Exchange - the connection to which your Portfolio will be connected.

For example: Binance

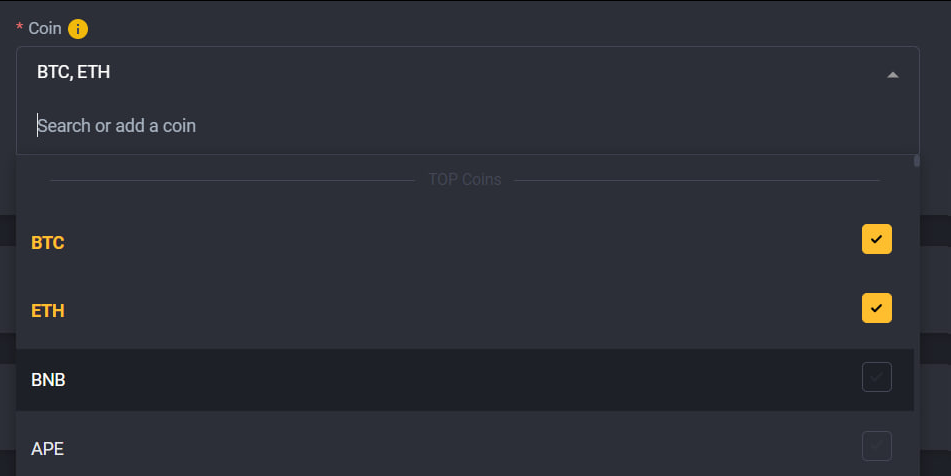

4. Coin - Choose a preferred set of coins (from 2 to 10)

For example: BTC and ETH

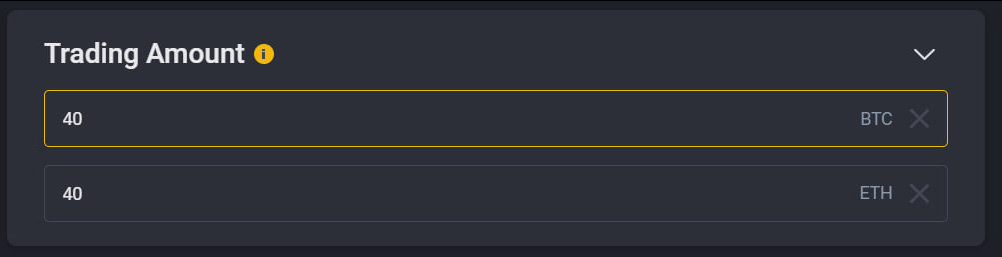

5. Trading Amount - Specify the amount that the portfolio will work with for each individual coin.

The amount will be equally divided into 4 orders: 1 starting and 3 safety orders.

Safety orders average your position if price goes in the opposite direction against your position.

Safety order bring your take profit target closer to current price.

For example: 40 USDT for BTC and 40 USDT for ETH.

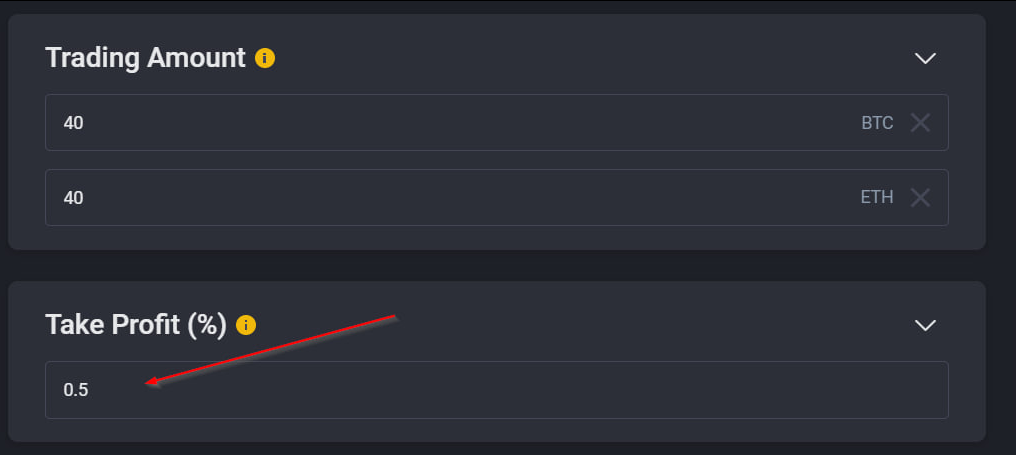

6. Take Profit - indicate, how much profit your portfolio should make for each coin.

Profit amount will be calculated based on your order amount

May be changed during active deals.

For example: 0.5%

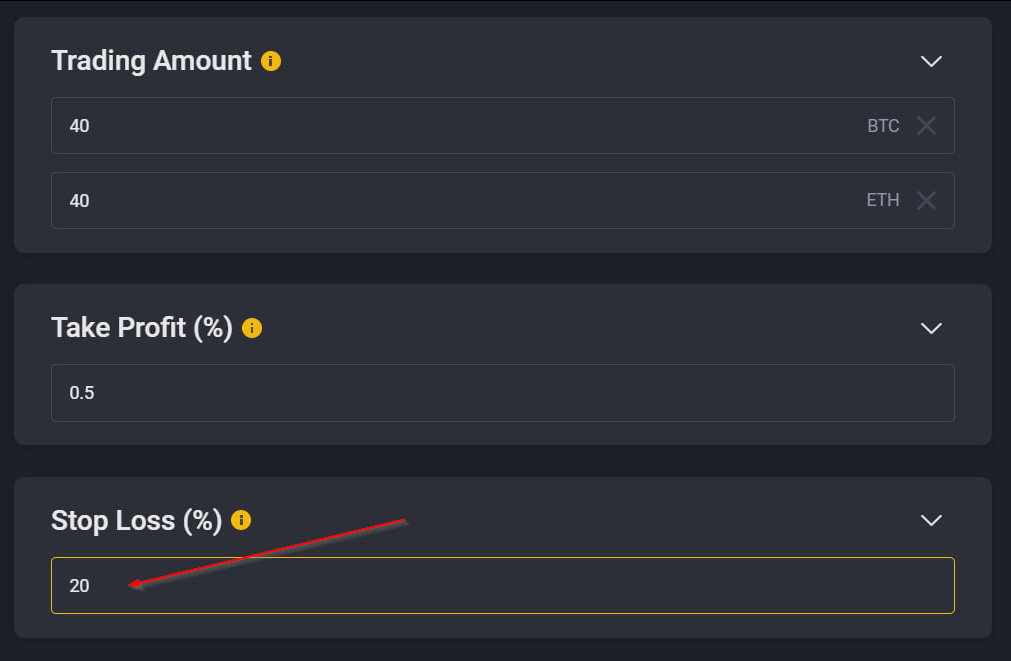

7. Stop Loss - indicate the % of price drop at which your portfolio should be closed by a each coin.

Stop loss % is calculated based on the start order execution price. May be changed during active deals.

For example: 20%

8. The final step is to save your Portfolio settings by clicking the Save or Save & Start Trading button.

If you choose the Save button - your Portfolio will be saved, but not activated. So you will need to click on the Launch button of this Portfolio to start trading.

If you click on the Save & Start Trading button - your Portfolio will be launched immediately and will start to search for a good point to enter the deal.

Support

If you will have any questions or need any help/assistance in setting up your first strategies - please contact our VIP manager in Telegram at @GT_App_CSbot.